Freeze on housing benefit decimating low-income renters’ ability to find secure homes

28.06.2023

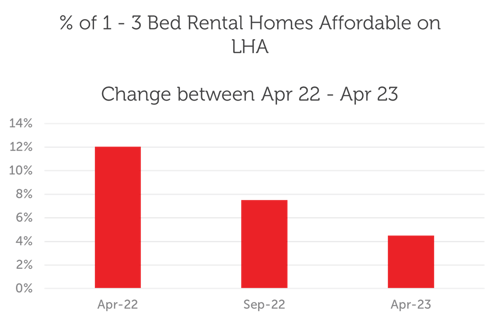

- Proportion of properties affordable on housing benefit in England has declined by two thirds in a year – down to just 4%

- Crisis warns of rising homelessness as households fall into arrears, with shortfalls between housing benefit rates and rental costs extending into the thousands

- Analysis comes as Crisis launches a new campaign which calls for a national mission to tackle homelessness for good

Low-income renters across England are facing destitution and homelessness as soaring rents and the freeze on housing benefit continues to eat away at the number of genuinely affordable homes available, national homelessness charity Crisis has warned.

New analysis by Crisis and property website Zoopla has found that just 4% of 1–3-bedroom properties listed in the last year were affordable to people who need housing benefit to help pay their rent. This is down from 12% in April 2022 (Fig. 1) despite the fact that 1.9 million households - over one in three who rent privately – need housing benefit to help pay for rent.

With so few properties available to rent at affordable rates, struggling renters are having to stump up thousands of pounds to cover huge shortfalls at a time when inflation remains high and household bills continue to put a strain on people’s budgets.

The analysis found that households are being forced to find, on average, an additional £1,300 for a one bed, £1,900 for a two bed and £2,900 for a three bed a year. Staggeringly, these shortfalls are nearly double what they were just a year ago.

This growing gap is pushing more people into poverty and closer to homelessness, with households unable to cut back to cover these mounting costs. It also means that for people currently facing homelessness, the hope of moving on is further and further from reach. Crisis is warning that people will increasingly have to rely on unsafe and insecure arrangements, such as sleeping on sofas, in cars or staying in hostels and B&Bs, as the foundation that is needed to ensure even a basic standard of living – a settled home – is out of reach.

The research reveals that the problem is being felt right across the country. There are 32 local authority areas where fewer than 1% of 1–3-bedroom properties are affordable to people who need housing benefit to pay their rent – including districts like Barnsley, Wigan and Mansfield.

As average monthly rental prices have increased by 11% across the UK in the last year, the amount of private rented homes affordable on Local Housing Allowance during the year has dropped by 55%. And while London has unsurprisingly seen a bigger decline in affordability, at 75%, the North West – traditionally a more affordable area to rent in – has seen a similar drop, with 68% fewer homes now affordable for people renting and on housing benefit (Fig. 2).

Housing benefit has been frozen since March 2020 and is based on rental prices for 2018-2019. With soaring costs continuing to wreak havoc on household finances, Crisis says that tens of thousands of low-income renters could become homeless if action is not taken.

This stark warning comes as Crisis launches ‘Make History: A Future free from Homelessness’ – a campaign urging the Westminster Government and all major political parties to make tackling all forms of homelessness a priority.

In the short term, the charity is calling for urgent investment in housing benefit so that people can pay their rent and find an affordable home. In the long-term Crisis says the Government must get to grips with increasing the supply of social housing if it is to end homelessness for good.

Matt Downie, Crisis Chief Executive, said: “It is incomprehensible that tens of thousands of low-income renters are being put at risk of destitution and homelessness because of political choices and Government inaction.

“For too long the private rental market has been relied upon to provide homes for low-incomes families while our social housing stock has been decimated. Yet we’ve ignored massive and unsustainable rent rises and, as a consequence, the poorest in society are completely priced out of finding a secure home. As mortgage rates continue to go up, we are facing a very real catastrophe as many landlords will be forced to pass these increased costs down to tenants who are already struggling to make ends meet.

“The Westminster Government, and all political parties, must wake up to the need for action if we’re to stop thousands of people from being pushed into homelessness. It’s vital that housing benefit is restored so it covers the cheapest third of rents and that a plan to deliver the genuinely affordable homes needed is put in place. The solutions are clear – let’s get on with delivering them.”

Richard Donnell, Executive Director at Zoopla, said: “The private rented sector is under huge pressure following years of low investment in new rental supply and with more private landlords leaving the market.

“Demand for private rented homes is being driven by a strong labour market, record-high immigration and higher mortgage rates pushing ownership further out of reach. The net result is higher private sector rents which continue to accelerate away from static local housing allowance rates stuck at 2019 levels.

“This combination of factors continues to reduce the availability of homes to rent for those on the lowest incomes with some wide disparities locally. It’s essential we focus on policies to boost investment in rental supply across all tenures. This will take time to build momentum, meaning a reset of housing benefit levels is the quickest way to deliver support for those looking for a path out of homelessness.”